Rewriting the rules for building wealth

We’re breaking down barriers to investing and equipping you with the knowledge and tools to unlock financial wellness.

WHAT WE OFFER

Investing reimagined for everyoneFeel like investing isn't for you? Don't count yourself out. We believe that wanting to start is enough. You belong here.

START BUILDING WEALTH TODAY

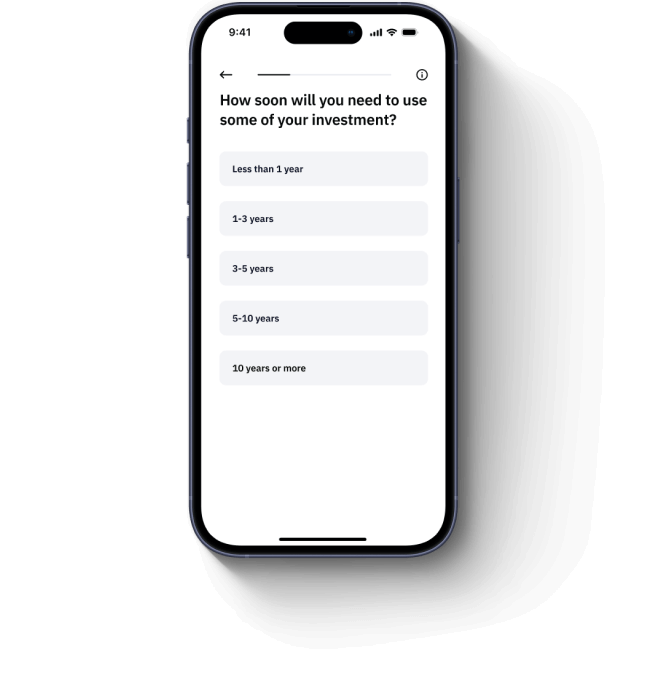

We meet you where you're at.

We learn about where you're at and where you want to go to help us understand how best to support you.

We build a portfolio just for you.

We recommend a mix of stocks and bonds based on your goals that we continuously rebalance.

We're with you every step of the way.

We give you tools to track your progress and resources to grow your investing confidence.

Build healthy habits with educational tools powered by behavioral science

Stay connected with your community through the Community Hub, where you can discover and keep up with our programs and events.

Dive into the Learning Center for engaging articles and videos that make complex financial topics easy to understand and act on.

Receive helpful reminders to stay on track and make steady progress toward your financial goals.

256-bit encryption

We have bank level security to protect and secure your personal data & information.

24/7 monitoring

We conduct system-wide, automatic monitoring to protect against unusual activity.

Two-factor authentication

We use two-factor authentication controls to secure access to your account.

Want to keep up with Stackwell? Subscribe to The Stack Up.

Stay connected with The Stack Up, our monthly newsletter designed to help you take control of your financial future. Whether you're ready to download the app and start building wealth, eager to stay informed about the latest from our team, or looking to expand your financial wellness knowledge, The Stack Up delivers it all—straight to your inbox.

EVEN MORE TOOLS

Subscribe to receive text affirmations

Stay on track with your financial journey through our regular text alerts. These timely reminders provide daily empowerment, inspiration, and focus, keeping you aligned with your financial goals.

Text "stackingwins" to +1 (646) 517-2701 to get affirmations straight to your phone.

By entering your phone number, you consent to receive marketing text messages from Stackwell at the number provided. Message and data rates may apply, and message frequency varies. You can unsubscribe at any time by replying STOP. Please view our Privacy Policy and Terms of Service.

FAQs

-

We believe investing is a powerful tool to build long term, sustainable wealth for Black and diverse audiences.

Stackwell is the only digital investment platform on the market that has specifically architected a solution to remove the social, emotional and cultural barriers to entry that have resulted in underinvestment in the Black community as well as other diverse communities.

We built our app with you in mind.

-

With Stackwell, you’re opening an account for investing, commonly known as a brokerage account (this is not a bank account).

Your Stackwell account helps you manage your money through automated portfolios that are recommended based on your risk profile and investment objectives, which are assessed during the account setup process.

The portfolios are comprised of a mix of low-cost equity and fixed income ETFs (exchange-traded funds).

We are a fiduciary, which means we act in your best interest.

-

No, we are happy to help you get started with your investing journey!

-

By law, Stackwell must verify a person’s identity before opening an investment account for them.

There are four key attributes that are commonly used to confirm a person's identity in the United States. These are:

Full name

Address

Date of birth

Social security number

Without verifying those four elements, we can't confirm your identity. Even if it wasn’t legally required, identity verification is a best practice that Stackwell would still perform because it protects you.

Our identity checks are meant to ensure someone trying to open an account “as you” really “is you”.

-

At Stackwell, we take privacy and security of our users very seriously. We don't share your personal information with anyone throughout and after the identity check process. We do not sell your information to third-party sellers.

-

The key to peace of mind is to focus on your goals and let the market work for you. Investing is like a watched pot (that never boils). Essentially, time will pass very slowly if it's the only thing you are thinking about.

Here's our suggested approach for periodic checkins:

Quarterly or Semi-Annually: Checking your Stackwell account every few months can be sufficient. This frequency allows you to review your portfolio performance without getting caught up in day-to-day market movements.

After Significant Life Changes: If there are major life events, like a change in income, retirement, marriage, or the birth of a child, consider revisiting your investment strategy and goals

Remember: While periodic check-ins are recommended, it is also important to stay informed about the economy and boost your investing knowledge.

We have resources for you within our app, our website, and The Stack Up monthly newsletter.

-

Although there is always some risk associated with investing, Stackwell makes sure your money is safe. Security and privacy are top priorities for us so we take our users' privacy and data very seriously.

-

Portfolio Details: Shows what kinds of assets (stocks, bonds, cash, etc.) your portfolio is made up of and their value. For every asset type, Stackwell will invest your money into an ETF (exchange trade fund) which is a collection of underlying assets.

For example, if your portfolio contains U.S. Stocks, the investment will be in an ETF that seeks to track the performance of the S&P 500 index, which is a basket of the largest publicly traded companies in the US.

-

We believe investing should be stress-free. Our mission is to help your money work for you by offering transparent, ready-to-go investment portfolios tailored to your goals.

Our portfolios are made up of best-in-class equity and fixed income exchange trade funds (ETFs), which are backed by proven investment strategy.

With Stackwell, you can relax by letting us handle the complexities of deciding stocks.

-

Performance Details: Shows you the value of your portfolio and how much money it has made over time.

This tab also shows what your portfolio is projected to earn over time based on your monthly contribution

-

Deposits usually take about 1-2 days for the cash to process. After that, it can take another 2-3 days for your investments to be fully set up.

-

Withdrawing funds usually takes 3-5 business days. This is because Stackwell has to sell some or all of your investments to get the cash.

Selling securities typically takes at least 2 business days. After we complete the withdrawal, your bank might take another 1-2 days to show the money in your account.

-

We appreciate you for participating in one of our programs! Your grant is linked to the email you gave to the organization that is sponsoring your program, and it'll automatically be given to you once you've fully completed the onboarding process with that same email.

If you signed up using a different email, no worries! You can add a secondary email by following these steps:

Log in to your account and tap the icon with your initials in the upper right-hand corner of the screen

Select "Personal Info," then tap the pen icon next to your email address. This will bring up the emails page.

Scroll down to the bottom and click on "Add secondary email."

Note: You can add up to 4 alternative emails to your Stackwell account.

Type the secondary email you'd like to add on the next page, then hit "Save."

Once saved, the new email will show as your secondary email on your account, and your grant will take 1-2 business days to get updated into your account.

-

Stackwell Capital Advisers, LLC is a SEC-registered Investment Advisor, and brokerage services are provided to clients by Apex Clearing Corporation, an SEC-registered broker-dealer and member of FINRA /SIPC. All investments held by Apex are protected by the Securities Investor Protection Corporation (SIPC).

Stackwell Investment accounts are in the custody of Apex Clearing Corporation which is SIPC-protected up to $500,000 total, including $250,000 in cash balances. This protects against losses resulting from the failure of a broker-dealer. The $500,000 amount is standard for investment companies.

For any questions about our compliance, email us at support@stackwellcapital.com

-

Customers must be at least 18 years old to open a Stackwell account. At this time, Stackwell's app is only available to United States citizens who have a valid social security number. Additionally, Stackwell is currently not available to people working for a brokerage firm.

For questions, email us at support@stackwellcapital.com

-

Anyone is welcome to join the Stackwell ecosystem! Our app addresses the needs of the Black experience as it relates to investing, but we also recognize that many of the same challenges impact other demographics as well.

If you are someone who wants to know where and how to start investing or learn more about financial wellness, then Stackwell is for you.

To join the Stackwell ecosystem, be sure to subscribe to our newsletter and/or follow us on our social media accounts, all of which can be found on the website.

-

The Stackwell team is here to support you on your wealth building journey.

If you ever need assistance with your account, email support@stackwellcapital.com